NEW YORK ANGELS MEMBERS DOUBLE INVESTMENTS IN 2024

By Simon Hopkins

New York Angels Celebrate a Strong Year of Investment Growth in 2024

The final numbers are in, and 2024 was a very successful year for New York Angels (NYA). Asserting itself as one of the most active angel investor groups in the United States, NYA Members doubled their investments from the previous year to $10M, funding innovation and entrepreneurship in almost 40 companies. The group significantly increased its investment activity from 2023, while expanding its support of early-stage companies.

A Strong Rebound After the Pandemic Slowdown

This robust performance in 2024 is especially notable given the challenges that the investment landscape faced during the COVID-19 pandemic. In the years following 2020, angel investment activity was notably subdued as market uncertainty and economic slowdowns caused investors to proceed with caution. Many startups struggled to secure funding during this period, leading to a dip in overall investment activity.

NYA demonstrated resilience and adaptability, steadily rebuilding momentum in the post-pandemic years. Last year’s total investment is a strong indicator that a pipeline of innovative and dynamic companies, born in the lock-down, has developed and investor confidence has returned to pre-pandemic levels.

Breaking Down the Investment Activity

In 2024, NYA Members’s $10 million investment was spread across 286 individual investments in 37 rounds, supporting 34 companies. The average round size was $270,000 with an average check size of $35,000, underscoring the group’s focus on providing meaningful support to promising startups.

The investments balanced a mix of new and follow-on deals, ensuring that both fresh ideas and existing portfolio companies received the support needed to thrive.

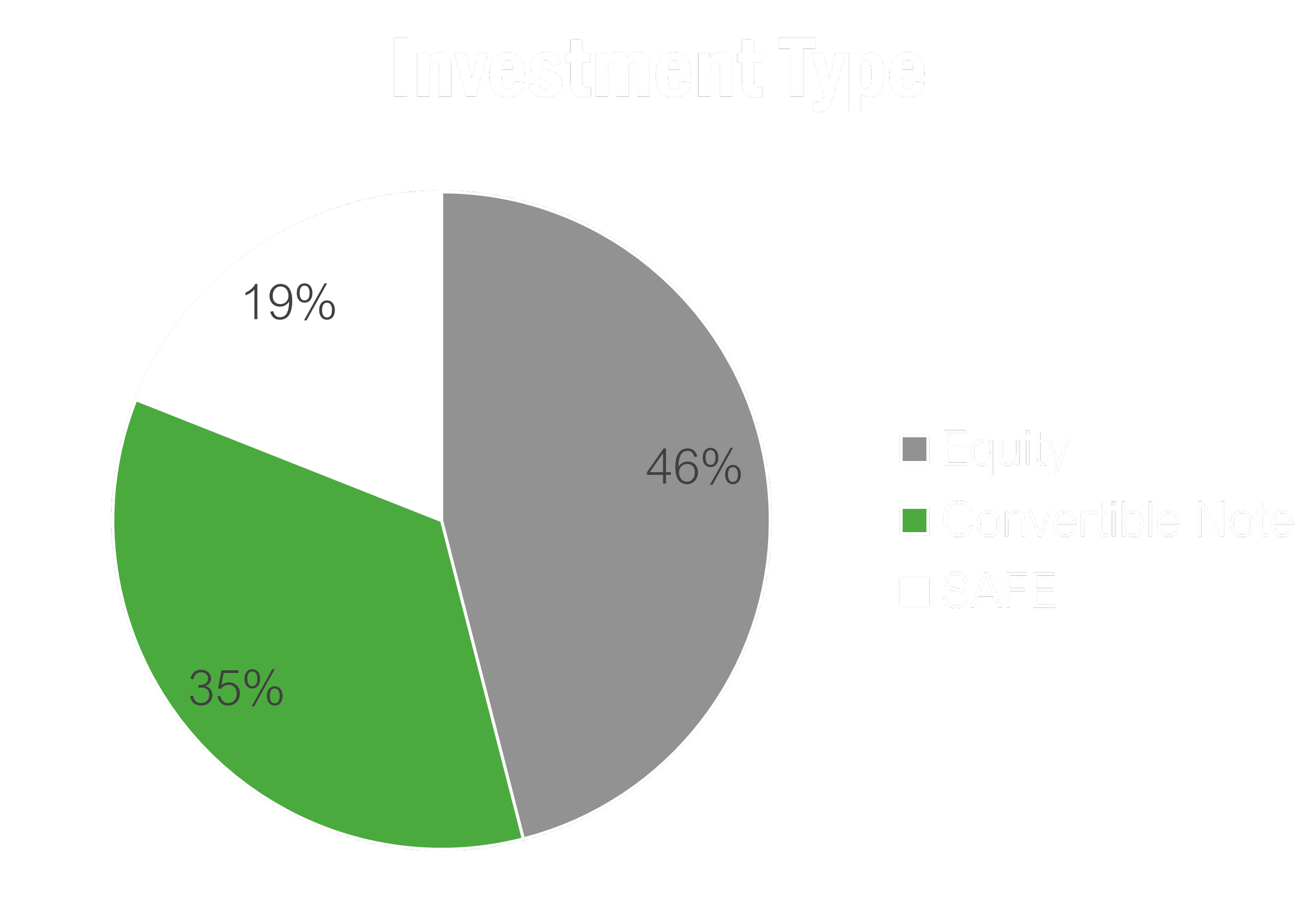

The Rise of the SAFE Note

One of the most notable trends shaping NYA’s investment strategy in 2024 was the increased use of SAFE (Simple Agreement for Future Equity) notes, which now account for 20% of the group’s total investments. This reflects a growing shift in how angel investors structure their deals andaligns NYA’s approach with broader market trends.

According to PitchBook, SAFEs accounted for over 30% of seed-stage deals in 2024. While NYA’s 20% share of SAFE investments is slightly below the national average, it highlights the group’s willingness to embrace deal structures that provide flexibility for founders, even though the terms of a SAFE may not be as “investor friendly”.

Geographical Diversity Fuels Growth

NYA’s investment portfolio in 2024 was geographically diverse, reflecting NYA’s strategy that sources the most exciting companies from a variety of ecosystems.

The majority of the investments were focused in the Northeast, where $7.3 million was deployed.

Other notable regions included:

West Coast: $0.7 million

Central U.S.: $0.6 million

Southern U.S.: $0.1 million

International: $1.2 million

The 2024 numbers represent a return to a focus on NYA’s “home” territory, after a more geographically diverse 2023 (Read more here). Any additional commentary on why the shift happened might be helpful. I believe NYA Members as a group did participate in more pitch events in the NE in 2024 – potentially a reason?

Strong Momentum in Early 2025

The momentum from 2024 has carried over into 2025. NYA has already made 41 individual investments in five rounds, supporting five companies – three of which are new additions to the portfolio, while two are follow-on rounds. This early activity suggests that 2025 is on track to be another impactful year for the group.

Why Entrepreneurs Choose NYA

Entrepreneurs looking for strategic investors are increasingly turning to NYA due to its reputation for providing not just capital but also mentorship, connections, and industry expertise. The group's members, many of whom are seasoned entrepreneurs and industry leaders, actively contribute their knowledge and networks to help portfolio companies succeed. If you are a founder who is seeking an investment partner, please visit our website to learn more.

Looking Ahead

As NYA continues to build on the success of 2024, the group is poised to maintain its position as a leading force in angel investing. With a proven track record of identifying high-potential startups and delivering strong returns, New York Angels remain a powerful catalyst for innovation and growth. NYA is always looking for members to join our dynamic and highly motivated group. If you are an accredited investor interested in angel investing or with existing early-stage investment experience, get in touch with NYA via our website.