NYA LONG-TERM ANALYSIS

Twelve Years of New York Angels Investments in Six Charts

Since making its first investment 22 years ago, New York Angels has been an important source of seed-stage capital in the United States. This analysis highlights total activity and means of investment, how the organization’s members work together and alone, NYA’s contribution to deal size and leadership, and industries of interest.

INVESTMENT ACTIVITY

Throughout its history, NYA has preferred priced rounds over convertible debt. Beyond deal count, total annual dollars invested have consistently been in priced deals.

From January 2010 through the end of 2022, NYA made 427 investments ranging in size from just over $2,000 to $9.2 million in a single round.

INVESTMENT VEHICLES

HOW NYA MEMBERS INVEST TOGETHER

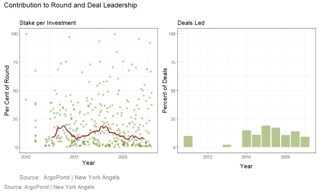

NYA’S ROLE IN DEALS

Because the group can readily bind a dozen or more angels into a deal, NYA has the capacity to lead early stage deals and has done so 36 times since 2010.

INDUSTRY FOCUS

Lastly, corrected for inflation, the value of companies backed by NYA members have been climbing for most of the past decade.

If NYA – following in the footsteps of early-stage venture capital in recent quarters – increasingly invests in more expensive follow-on rounds of companies it has already backed, pre-money valuation trends may rebound.

In recent years, broad participation in individual deals is taking place more often, and the number of deals with more than 10 NYA members involved has increased over time.

By both deal number and dollar amount, three industries have drawn the most attention amongst NYA members:

• Healthcare, Biotech, and Medical Devices

• Consumer Products and Services

• Financial Services